milwaukee county wi sales tax rate

This lookup does not identify any other taxes that may also apply such as the local exposition district taxes premier resort area tax. Milwaukee County WI Sales Tax Rate.

Sales Taxes In The United States Wikiwand

The Ozaukee County Sales Tax is collected by the merchant on all qualifying sales made.

. Wisconsin has state. Additional information about these taxes is contained in. You can print a 55 sales tax table here.

Groceries and prescription drugs are exempt from the Wisconsin sales tax. You may use this lookup to determine the Wisconsin state county and baseball stadium district sales tax rates that apply to a location in Wisconsin. Foreclosed Properties for Sale.

Top Property Taxes Milwaukee. To review the rules in Wisconsin visit our state-by-state guide. 2018 Brown County adopted the county sales tax.

The Ozaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state sales tax and 060 Ozaukee County local sales taxesThe local sales tax consists of a 050 county sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc. 2036 North Prospect Avenue Unit. The county sales tax rate of 05 is imposed on retailers making taxable retail sales licenses leases or rentals or providing taxable services in a Wisconsin county that has adopted the county tax.

Wisconsin Sales and Use Tax Information. The current total local sales tax rate in Milwaukee. 1807 Milwaukee WI 53202.

The Wisconsin sales tax rate is currently. Within the district food and beverages for on-premises consumption are subject to a 050 tax 025 prior to July 1 2010 rental cars to a 3 tax and hotel rooms and. The 2018 United States Supreme Court decision in South Dakota v.

3 rows Milwaukee County. 2022 Wisconsin Sales Tax By County. The Milwaukee County Sales Tax is 05.

Click any locality for a full breakdown of local property taxes or visit our Wisconsin sales tax calculator to lookup local rates by zip code. Detach the remittance advice located at the bottom of the delinquent property tax bill and include it with your check in the envelope provided for mailing. The Wisconsin sales tax is a 5 tax imposed on the sales price of retailers who sell license lease or rent tangible personal property certain coins and stamps certain leased property affixed to realty or certain digital goods or sell license perform or furnish taxable services in Wisconsin.

Milwaukee County Treasurers Office. Delinquent Property Tax payments may be mailed to the Milwaukee County Treasurers Office at the following address. And 05 county sales and use taxes.

Has impacted many state nexus laws and sales tax collection requirements. Average Sales Tax With Local. 6 rows The Milwaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state.

4 rows The current total local sales tax rate in Milwaukee WI is 5500. Wisconsin has 816 special sales tax jurisdictions with local sales taxes in. Counties and cities can charge an additional local sales tax of up to 06 for a maximum possible combined sales tax of 56.

All retailers that are registered to collect and remit the 5 Wisconsin state sales and use tax are also required to. Download Wisconsin Sales Tax Rates By ZIP Code County and City Do you need access to sales tax rates for every ZIP code. What is the sales tax rate.

For tax rates in other cities see Wisconsin sales taxes by city and county. The December 2020 total. Wisconsin State County and Stadium Sales Tax Rate Look-Up.

9th St Room 102. 9th St Room 102. The Wisconsin state sales tax rate is currently.

Verification and processing of claims takes four to eight weeks. Milwaukee County is home to over 950000 people living in one of 19 communities which range in size from the City of Milwaukee with 595000 residents to the Village of River Hills with roughly 1600 residents. The 55 sales tax rate in Milwaukee consists of 5 Wisconsin state sales tax and 05 Milwaukee County sales tax.

The county use tax rate of 05 is imposed on purchasers of items used stored or consumed in counties that impose county tax. The Treasurers office will contact the claimants to inform them when their claim is completed. Can I get tax rate info for multiple states or recurring updates when tax rates change.

The Milwaukee County sales tax rate is. The City of Milwaukee created a local exposition district the Wisconsin Center District which is contiguous to Milwaukee County. The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543.

There is no applicable city tax or special tax. The minimum combined 2022 sales tax rate for Milwaukee Wisconsin is. Milwaukee County in Wisconsin has a tax rate of 56 for 2022 this includes the Wisconsin Sales Tax Rate of 5 and Local Sales Tax Rates in Milwaukee County totaling 06.

Historical Sales Tax Rates for Milwaukee 2022 2021 2020 2019. This is the total of state county and city sales tax rates. The Milwaukee sales tax rate is.

You can find more tax rates and allowances for Milwaukee County and Wisconsin in the 2022 Wisconsin Tax Tables. WI Sales Tax Rate. Menominee County WI Sales Tax Rate.

A county-wide sales tax rate of 05 is. The County sales tax rate is.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

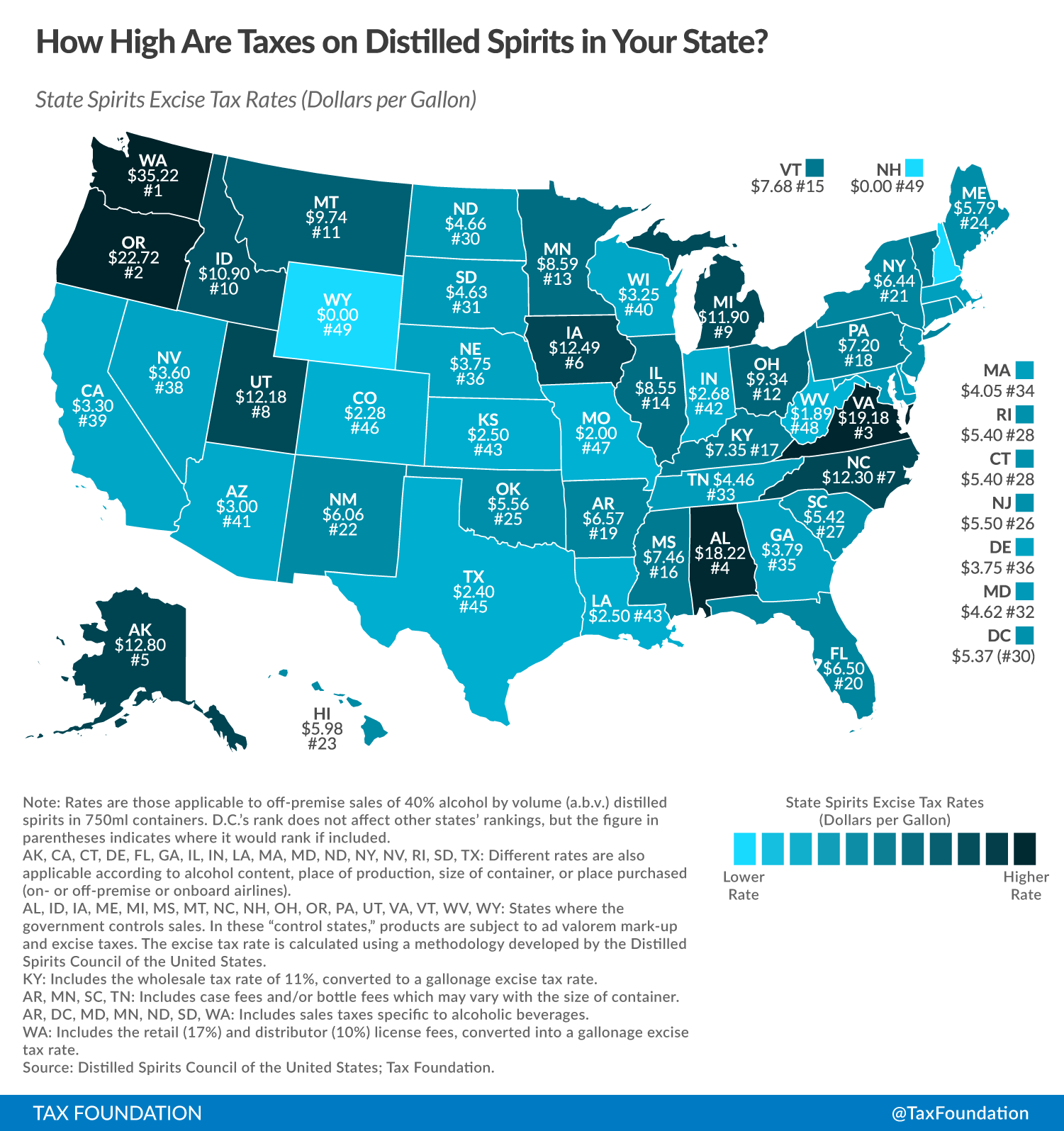

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Wisconsin Sales Tax Rates By City County 2022

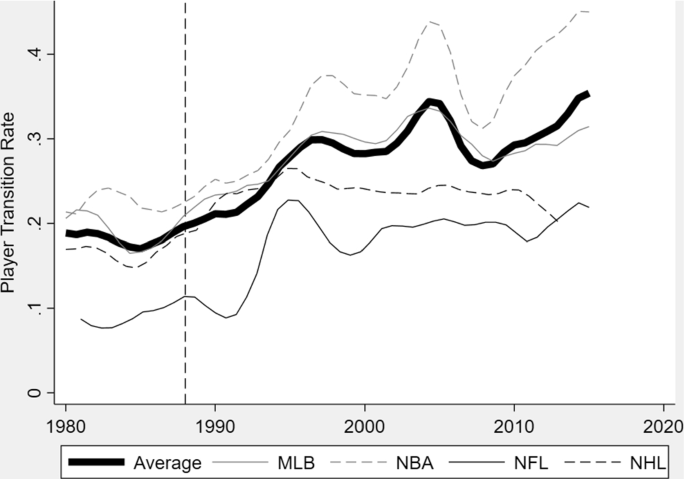

State Income Taxes And Team Performance Springerlink

Sales Taxes In The United States Wikiwand

Revenue Wisconsin Budget Project

Revenue Wisconsin Budget Project

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Wisconsin Property Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

Wisconsin Sales Use Tax Guide Avalara

North Central Illinois Economic Development Corporation Property Taxes

Wisconsin Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

Which Cities And States Have The Highest Sales Tax Rates Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation