wichita ks sales tax rate 2020

The Kansas sales tax rate is currently. Depending on local municipalities the total tax rate can be as high as 106.

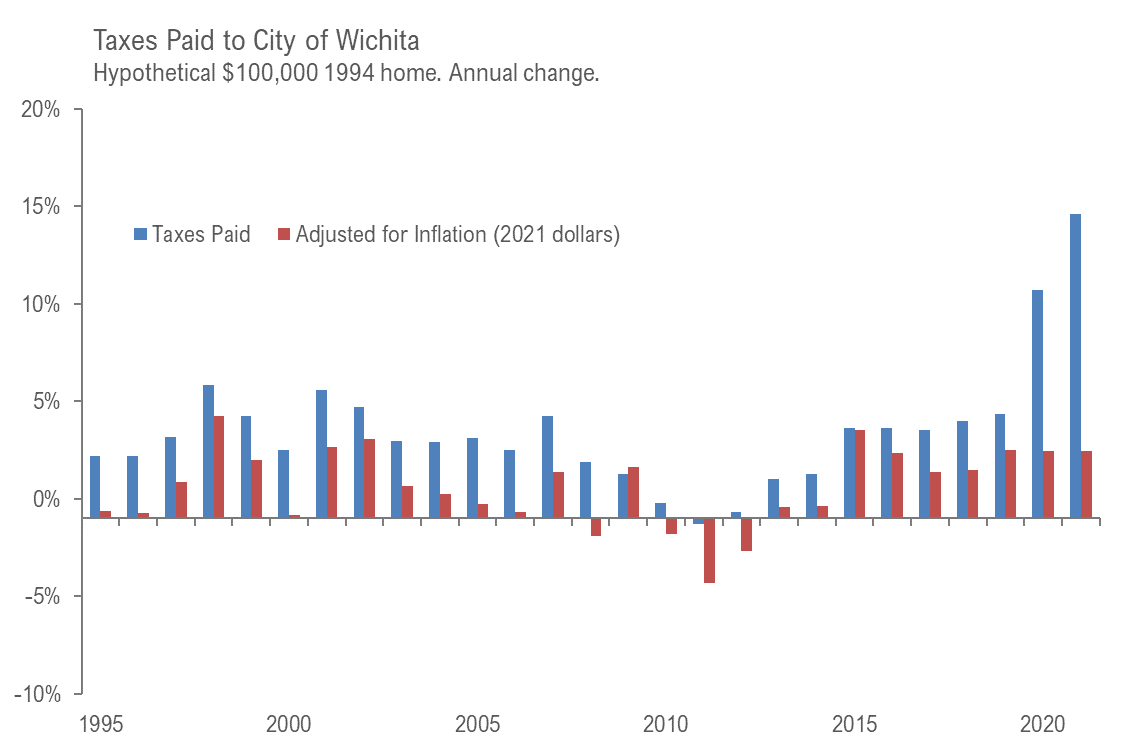

Wichita Property Tax Rate Up Just A Little

The December 2020 total local sales tax rate was also 7500.

. In 1994 the City of Wichita mill levy rate the rate at which real and personal property is taxed was 31290. For tax rates in other cities see Kansas sales taxes by city and county. The Wichita sales tax rate is.

The minimum combined 2022 sales tax rate for Wichita County Texas is. Wichita County collects a 2 local sales tax. 2020 rates included for use while preparing your income tax deduction.

The Kansas KS state sales tax rate is currently 65. The 75 sales tax rate in Wichita consists of 65 Puerto Rico state sales tax and 1 Sedgwick County sales tax. Wichita KS Sales Tax Rate.

In 2022 the minimum combined sales tax rate within Wichita Kansas 67202 zip codes is 75. The minimum combined 2022 sales tax rate for Johnson County Kansas is. In 2020 it was 32749 based on the Sedgwick County Clerk.

This table shows the total sales tax rates for all cities and towns in Wichita County including all local taxes. 679 rows 2022 List of Kansas Local Sales Tax Rates. This is the total of state and county sales tax rates.

Only the proportion of net income generated within the state is subject to Kansas income tax. Other local-level tax rates in the state of Kansas are quite complex compared against local-level tax rates in other states. Kansas has a lower state sales tax than 827 of.

The 2018 United States Supreme Court decision in South Dakota v. There is no applicable city tax or special tax. Kansas has a 65 sales tax and Wichita County collects an additional 2 so the minimum sales tax rate in Wichita County is 85 not including any city or special district taxes.

Kansas corporate tax rate is 700 400 of Kansas taxable net income plus 300 surtax 2011 on taxable net income in excess of 50000. Abilene KS Sales Tax Rate. You can print a 75 sales tax table here.

The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200 county sales tax. There is no applicable city tax or special tax. This is the total of state county and city sales tax rates.

Has impacted many state nexus laws and sales tax. The County sales tax rate is. Kansas has a 65 statewide sales tax rate but also has 528 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1987 on top of the state tax.

This is the total of state and county sales tax rates. Wichita County Sales Tax Rates for 2022. 3 lower than the maximum sales tax in KS.

The Kansas state sales tax rate is 65 and the average KS sales tax after local surtaxes is 82. Kansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 4. Ada KS Sales Tax Rate.

For tax rates in other cities see Puerto Rico sales taxes by city and county. What is the sales tax rate in Wichita Kansas. City Total Sales Tax Rate.

This means that depending on your location within Kansas the total tax you pay can be significantly higher than the 65 state sales tax. The Johnson County sales tax rate is. The Wichita County sales tax rate is.

What is the sales tax rate in Wichita County. The Kansas state sales tax rate is currently. You can find more tax rates and allowances for Wichita County and Kansas in the 2022 Kansas Tax Tables.

The City of Wichita property tax mill levy rose slightly for 2020. Average Sales Tax With Local. The 2018 United States Supreme Court decision in South Dakota v.

The 2018 United States Supreme Court decision in South Dakota v. Thats an increase of 1459 mills or 466 percent since 1994. This rate is the sum of the state county and city tax rates outlined below.

The current total local sales tax rate in Wichita KS is 7500. Abbyville KS Sales Tax Rate. Wichita collects the maximum legal local sales tax.

The Wichita County Sales Tax is collected by the merchant on all qualifying sales made within Wichita County. This rate includes any state county city and local sales taxes. Lowest sales tax 55 Highest sales tax 115 Kansas Sales Tax.

What is the sales tax rate in Wichita County. Kansas has 677 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Wichita County in Kansas has a tax rate of 85 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Wichita County totaling 2.

The Wichita County sales tax rate is. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax. This is the total of state and county sales tax rates.

The latest sales tax rate for Wichita KS. Counties and cities can charge an additional local sales tax of up to 35 for a maximum possible combined sales tax of 10. You can print a 75 sales tax table here.

The Kansas state sales tax rate is currently. The minimum combined 2022 sales tax rate for Wichita County Kansas is. The Texas state sales tax rate is currently.

The minimum combined 2022 sales tax rate for Wichita Kansas is. Admire KS Sales Tax Rate.

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Sales Tax Rates In Major Cities Tax Data Tax Foundation

My Local Taxes Sedgwick County Kansas

Jonesboro Sales Tax Rates Jonesboro Use Tax Rates

Wichita Property Tax Rate Up Just A Little

/do0bihdskp9dy.cloudfront.net/06-10-2022/t_49248d72a5b3465f8f404db00cb424d8_name_file_1280x720_2000_v3_1_.jpg)

Shoppers Could Soon See Slight Sales Tax Drop At Some Ne Wichita Businesses

Wichita Property Tax Rate Up Just A Little

My Local Taxes Sedgwick County Kansas

Schmidt Kelly Ring Up Intriguing Campaign Narratives About Kansas Sales Tax Rate Kansas Reflector

Wichita Property Tax Rate Up Just A Little

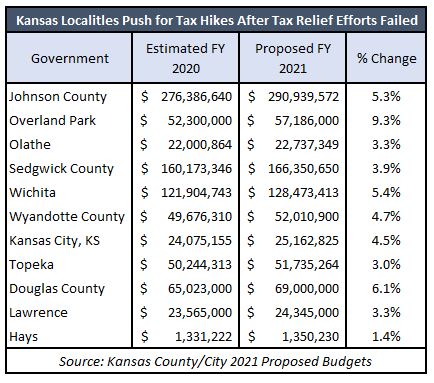

Kansas Counties And Cities Hike Taxes Amidst Covid Recession Kansas Policy Institute

/do0bihdskp9dy.cloudfront.net/06-10-2022/t_49248d72a5b3465f8f404db00cb424d8_name_file_1280x720_2000_v3_1_.jpg)

Shoppers Could Soon See Slight Sales Tax Drop At Some Ne Wichita Businesses

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Sales Tax Rates In Major Cities Tax Data Tax Foundation